When I visited Canada for summer vacation about a month ago, my family and I rode in an Uber to the Montréal Trudeau International Airport on our way home. Our driver, Stelios, a Canadian native, had plenty to say when he answered our questions about Canada and what it was like living there.

When my sister asked what he thought about the Canadian healthcare system, I expected his face to light up as he talked about the amazing benefits or at least an approving nod because, after all, the only thing I knew about Canadian politics is that the healthcare is excellent. Instead, he shook his head heartily and said, “No, it’s no good.”

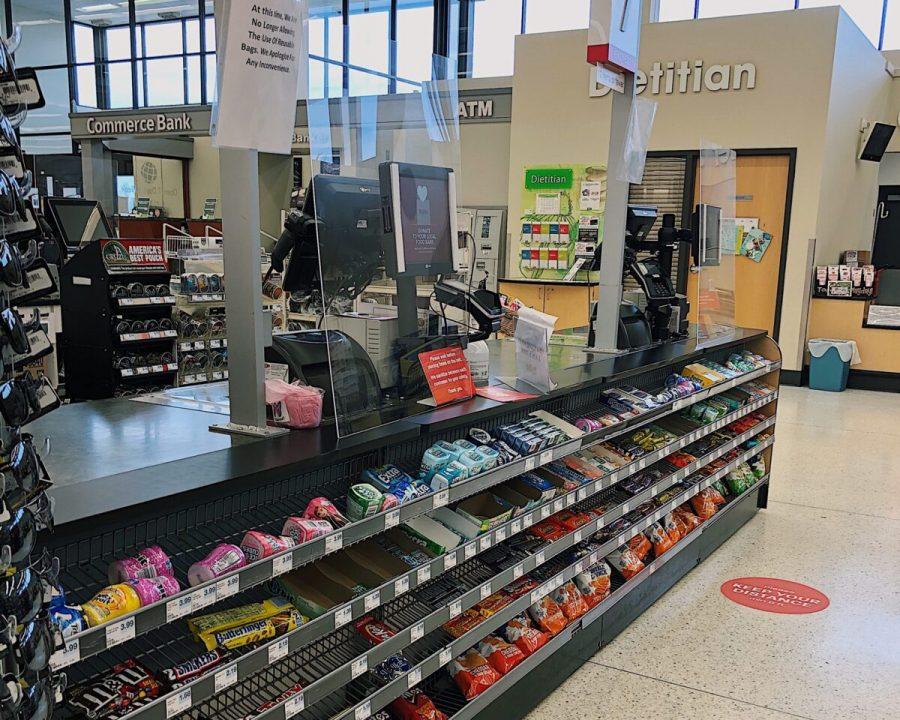

The conversation went on for probably another 15 minutes as my sister, as shocked as I was, asked more questions. The main consensus was that even though everyone is insured, the waiting time Canadians go through to receive treatment is so long that people can’t access the care they’ve paid such high taxes for. According to the Fraser Institute, the median waiting time in Canada was 19.8 weeks between referral from a general practitioner and receival of treatment. This wait time is 113 percent longer than in 1993, when it was just 9.3 weeks.

Although I’ve always thought universal healthcare would be great for the United States; after all, it is a common characteristic among countries like Denmark and Finland, Stelios’ comments got me thinking. The taxes in Canada were unbelievably high — in Quebec, the sales tax is about ten percent, the goods and services tax is five percent and if you were eating in a restaurant, you might pay an eighteen percent tip. Altogether, a customer could end up paying an extra third of their meal cost in taxes. To compare, the U.S. tax rate is about 18%.

The healthcare system of Canada, called single-payer health care, is one that many legislators in the U.S. want to transition into. It provides insurance coverage to all under one government-run plan.

Although Medicare for All has many different plans for implementation, Bernie Sanders’ policy is the most popular so far. He has 14 co-sponsors including presidential candidates Elizabeth Warren, Cory Booker and Kamala Harris. His plan includes a benefits package similar to Canada’s single-payer system, however, his version is exceptionally generous. For example, his version covers vision and dental care, prescription drugs, rehabilitative services and home health services while Canada’s does not.

In addition to this, consumers would not be subject to out-of-pocket spending aside from prescription drugs. Emergency room and doctor visits are fully covered by the Medicare plan.

These uncovered services are usually paid for by private insurance plans, meaning more out-of-pocket spending for consumers. Because it is more generous than private insurance and the current Medicare system, Sanders’ health plan is likely to cost significantly more than plans other countries have adopted.

The main question opposers of Medicare for All ask is: how exactly will it be paid for? According to the Urban Institute, the plan would cost an estimated $32 trillion over 10 years. Sanders hasn’t released a specific payment plan, but he does have a list of ways to raise revenue, such as a 7.5 percent payroll tax on employers and a wide array of taxes on the wealthy, including corporations. Even with all of these revenue-boosters, the program may still be too ambitious to be fully funded.

It’s also hard to say whether overall healthcare costs will go up or down. On one hand, the simpler single-payer plan has the potential to control prices, such as drug costs, more efficiently than the current system does. This would streamline the process and cut administrative costs.

On the other hand, the fact that much more people would be insured and not have any out-of-pocket costs would drive up costs greatly — having no deductibles and copays, people would make many more doctors’ office visits.

Many Americans don’t know where they stand on the issue of Medicare for All. Although polls show that the idea of single-payer has grown more popular recently, their opinions aren’t set in stone. Support slips when people are told about potentially higher taxes, and support grows when they are told about potentially lower administrative costs.

Voters have a lot of questions and opinions about Medicare for All to choose from. Is universal healthcare a must-have for the U.S.? Are increased taxes on hard-earned money concerning? Do voters think the plan is even feasible? Americans must decide what matters most to them and use their vote to choose a plan they agree with.

Do you think free healthcare is necessary for Americans? Let us know in the comments below!

Categories:

Medicare for all, explained

September 12, 2019

1

0

More to Discover

Kellen Sapp • Sep 12, 2019 at 10:21 am

I think it’s interesting that people making more doctor’s appointments was brought up as a negative. To me, this seems like one of the main purposes of single-payer insurance. I think a big part of it is making sure people get the healthcare they need. Making going to the doctor cheaper allows low-income families to access the healthcare they need, and yes that means more doctor visits, but that’s kinda the whole point. We may need to plan and anticipate this jump in quantity, but it should not be counted as a failure of the system, as it is not a bad thing for people to get the healthcare they deserve.