The Free Application for Federal Student Aid (FAFSA) application made additional updates for its 2019-20 application. The adjustments include an increase in the Need Analysis Income Threshold, an update to the online website, a new feature for error notifications and modifications to the third-step verification process for the Systematic Alien Verification for Entitlements (SAVE), a part of the Department of Homeland Security, according to Nitrocollege.com and Ifap.ed.gov.

The most significant revision to the FAFSA application regards the Need Analysis Income Threshold for an automatic-zero Expected Family Contribution (EFC). The EFC is a measure of a family’s financial status and strength, which includes information about a family’s taxed and untaxed income, assets and benefits. Having a zero EFC means a family doesn’t have the ability to cover any college costs. After the government assesses the financial background of a student’s family, the government determines how much financial aid the student should receive. The income threshold for an automatic zero EFC increased from $25,000 to $26,000 for the 2019-20 application.

All of the changes were designed by the FAFSA program to make the process for applying for financial aid more accessible, less confusing and more opportunistic for all high school students. The changes most affect students whose family incomes are below or near the Missouri poverty level. For a standard family of four, the poverty level is at $25,100 according to aspe.hhs.gov.

Senior Madi Polniak said the changes are worthwhile and meaningful. Polniak described her family’s income “about in the middle,”adding that the FAFSA application will help her afford college tuition.

“I think the new FAFSA changes will be really beneficial for students,” Polniak said. “It will create more opportunities to fund higher education for students that may have trouble paying for college, even if just by a small difference.”

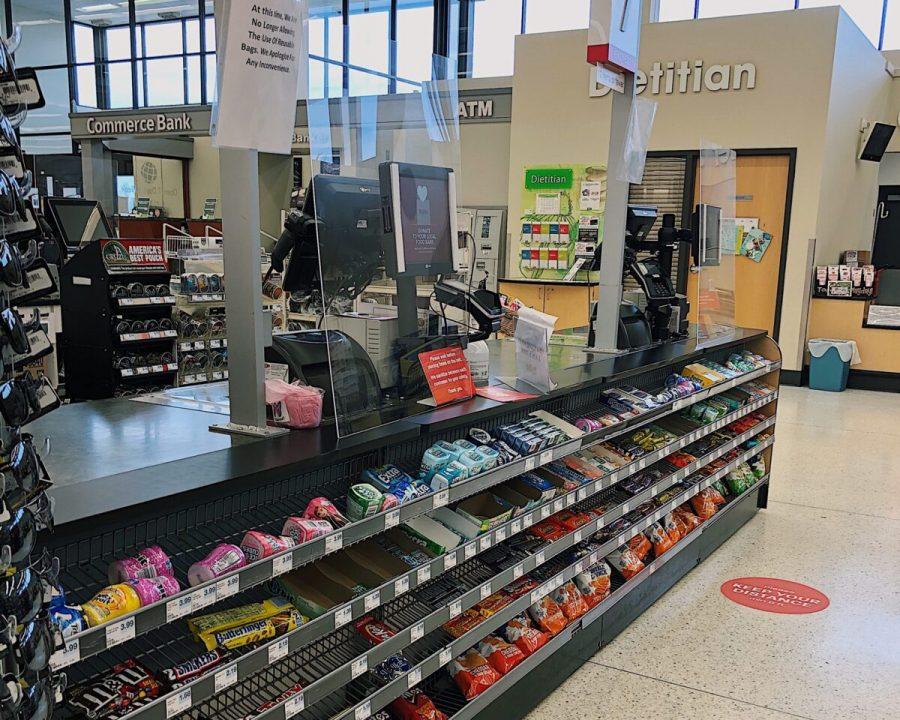

Polniak added that the developments to the website, studentaid.ed.gov, have made it easy to browse and go through.

“The [site] looks daunting at first, but I think once you explore, anyone can find what they are looking for quickly.” Polniak said.

Fellow senior Shawn Yoo agrees with Polniak about the improved convenience and detail of the technological updates to the website. Redesigns to the site help it be more compatible with almost any device, meaning it will be able to fit on the screens of desktops, laptops and mobile devices. Yoo noted the updates to the FAFSA mobile app make it more straightforward to use.

“I think the mobile app changes are awesome since a lot of students struggle to complete their FAFSA form, and by making FAFSA more accessible, students will stress less about it and spend more time on completing their application,” Yoo said. “I honestly don’t think the changes [could] negatively impact anyone.”

Kayla Klein, a Financial Aid Adviser at the University of Missouri, said FAFSA makes updates every year. Klein, who also serves as the Early Awareness Committee Chair for the Missouri Association of Student Financial Aid Personnel, helps RBHS students and their families with the FAFSA application every year. She specifically helps students and families find funds to help with post-secondary educational costs.

Klein said the new skip logic on the website is a positive for students make the process of completing the FAFSA easier.

“FAFSA updates and makes changes to the form every year. Updating the skip logic based on how you answer previous questions is important for families and students,” Klein said. “It helps to ensure that they are not answering questions if not needed… [and] it allows them to complete the application in a quicker time frame.”

Despite the helpful changes, Yoo said he is still concerned about completing the FAFSA application because his family doesn’t have a recent tax form. Yoo and his family recently received its green card after moving to the United States from South Korea in 2017. Because of this, Yoo believes the completion of the FAFSA application will be difficult to fill in as it requires the 2018 tax form while his family doesn’t have any tax form reported until this year.

While Yoo acknowledged the FAFSA application would be difficult and time-consuming for him to fill out, he is happy the FAFSA organization at least tried to create easier availability for the students.

“My family and I moved to United States in 2017, and we don’t have a tax form since my family recently received their green card. So FAFSA is going to be pretty hard for me to fill in as it requires the 2018 tax form and my family doesn’t have any tax form reported until this year,” Yoo said. “[But], having a mobile app for FAFSA [at least] provides [meaningful] access to FAFSA.”

For Polniak and Yoo, the technological adjustments to the error notifications feature are also very helpful. The new feature on the form notifies to the student about incomplete or missing fields before the student can move on to the next question.

“Personally, I [often] forget my password to [many things],” Polniak said. “So new changes to how the [Fafsa.gov] responds to errors really helps me.”

With the college admissions process expanding little by little each year, Polniak said she isn’t surprised to hear that the FAFSA application will undergo more modifications. Yoo suggested potential areas of improvement for FAFSA application and its overall process.

“Maybe more explanations or guides could be attached to FAFSA questions,” Yoo said. “I think it’s still hard to complete it unless I have someone else that can help me complete my form.”

While the FAFSA application is a constant work in progress, Klein said the opportunities heavily outweigh the detriments.

“I encourage students to complete the FAFSA when talking to them. I know that people say they will not get anything from it, but I always say it is better to have one on file even if it is there for an emergency,” Klein said. “The work that I and my colleagues [do] across the state is [meant] to help families pay for a post-secondary education and that includes technical schools. We all know how a FAFSA can help to achieve that goal and that is why we are out helping families on our campuses and in the communities that we serve.”

What do you think about the new changes to FAFSA? Let us know in the comments below.

William Yoo • Nov 21, 2019 at 12:07 pm

I’m glad that this crucial information is easily accessible to us, I didn’t even know this happened until reading the story.