Senior Tasha Brooks was a dishwasher. Paid minimum wage, she worked in the kitchen of her North Callaway High School to clean her classmates’ dirty lunch trays. Brooks didn’t appreciate the lack of cleanliness in her workplace, but she kept a little extra money.

“When you get paid under the table, it’s just dirty work that you have to do,” Brooks said. “I was washing trays with nasty food spread across them, milk and everything. It was just so gross. It’s a dirty job.”

Brooks didn’t pay taxes on her income. She worked “under the table” as an undocumented worker and saved her money from going to the Internal Revenue Service.

Brooks recognized that her job had benefits besides not paying taxes. It fit into her schedule, which was a big advantage, even though her working conditions were not exactly ideal. Since she only worked a few hours a day, she also learned time management.

“I would eat my lunch before lunch started,” Brooks said. “When they started serving everyone else, I’d be back in the kitchen waiting for trays, and I’d just keep washing them and washing them.”

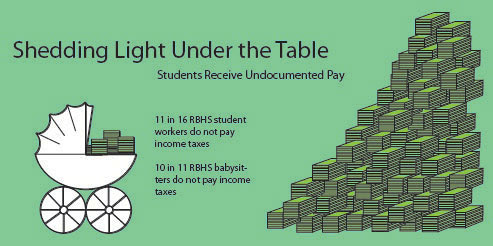

The IRS requires any dependent who isn’t “age 65 or older or blind” to file a tax return if their gross earned income is more than $5,800, according to Publication 501. Failure to file a tax return when required is against the law, and there are punishments for violators.

According to the Missouri Department of Labor and Industrial Relations, the “employers that knowingly misclassifies their employees face penalties in the amount of $50 to $1,000 per day per misclassified worker, and/or up to six months in jail per violation.”

Although it might seem hard for the IRS to catch these undocumented workers, those caught are reported and punished accordingly. In 2011, the Missouri Department of Labor and Industrial Relations identified 9,090 undocumented workers in Missouri.

Along with the risk of being caught, undocumented workers potentially face other disadvantages, like having little leverage with their bosses for raises or irregular hours.

Senior Devin Carney, a nanny, said her job has some of these negative aspects. Although Carney’s job isn’t as demanding as Brooks’, she recognizes she is missing out on the experience an official job can give.

“Whenever I actually get a real job, everyone else is going to know what to do and I’m going to be like, ‘Oh, you fill this form out?’’’ Carney said. “I’m not going to know exactly [what to do]. I’m sure I’ll figure it out but with less experience.”

Brooks overlooked the hard labor and dirty conditions since the hours and location worked for her.

It was “something to do, to keep me out of trouble and to keep me out of all the drama in the school,” Brooks said. “I think it was a really good working experience for me. Plus, I didn’t have to go anywhere. I didn’t have to leave school … [and] it was convenient for my family.”

Just as Brooks appreciated the benefits that came with her job, Carney welcomes the freedom. She said she wouldn’t have such perks with a different job.

“I [have] more flexible hours or a personal connection with just me and the family,” Carney said, “and I kind of [have] guaranteed hours. … If a business is doing bad they might cut some pay or cut the number of hours in a work week. I don’t have to worry about that.”

Carney said babysitters and nannies shouldn’t feel guilty for not reporting income, since such jobs can’t be compared to jobs in the workplace.

“Everyone needs someone to babysit their kids. It’s not a bad thing,” Carney said. “I feel like ‘under the table’ sounds kind of like a derogatory term, like it’s really bad, but so many [people] babysit.”

However, Laura Weiland, President of the Nanny Tax Company in Park Ridge, Ill., said there are both positive and negative aspects to working under the table, but the disadvantages clearly outweigh the benefits.

“The employee does not have a record of their wages. If they want to buy a car or rent an apartment, it doesn’t look like they have ever worked,” Weiland said. “If they are laid off from this job, they may not be eligible for unemployment benefits.”

The Nanny Tax Company makes paying taxes easier for household employers by helping them through the process. Weiland said such jobs actually hurt the employee because they could get caught and punished for tax fraud through fines, penalties and trouble finding employment later in life.

“My opinion is that people should follow the law,” Weiland said. “People who employ someone to work in their home and decide not to pay the taxes are taking advantage of the employee. If they don’t like the law, then they should work with their senators and congressmen to change the law. It is not fair for only some people to comply with the law while others are disobeying it.”

By Afsah Khan